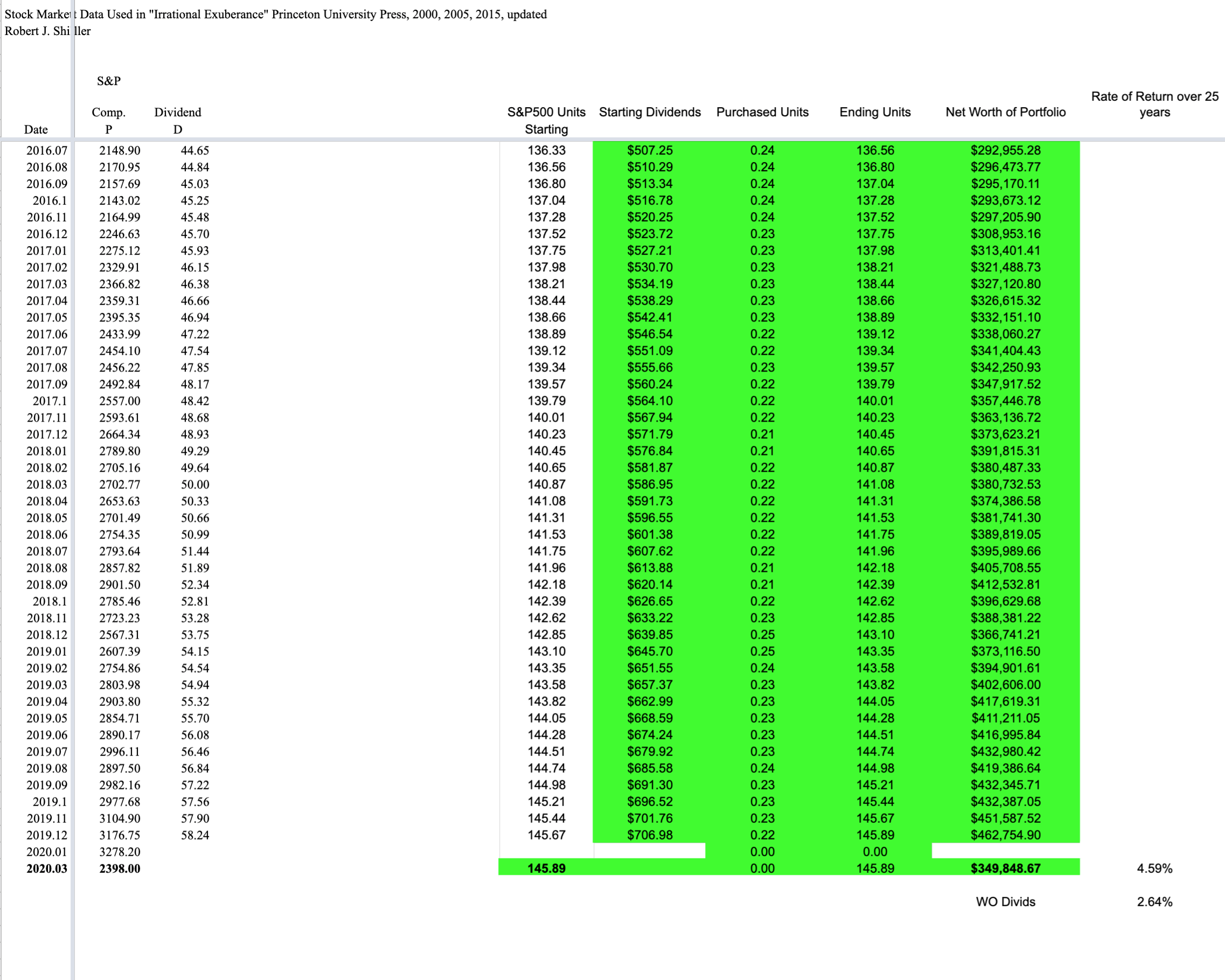

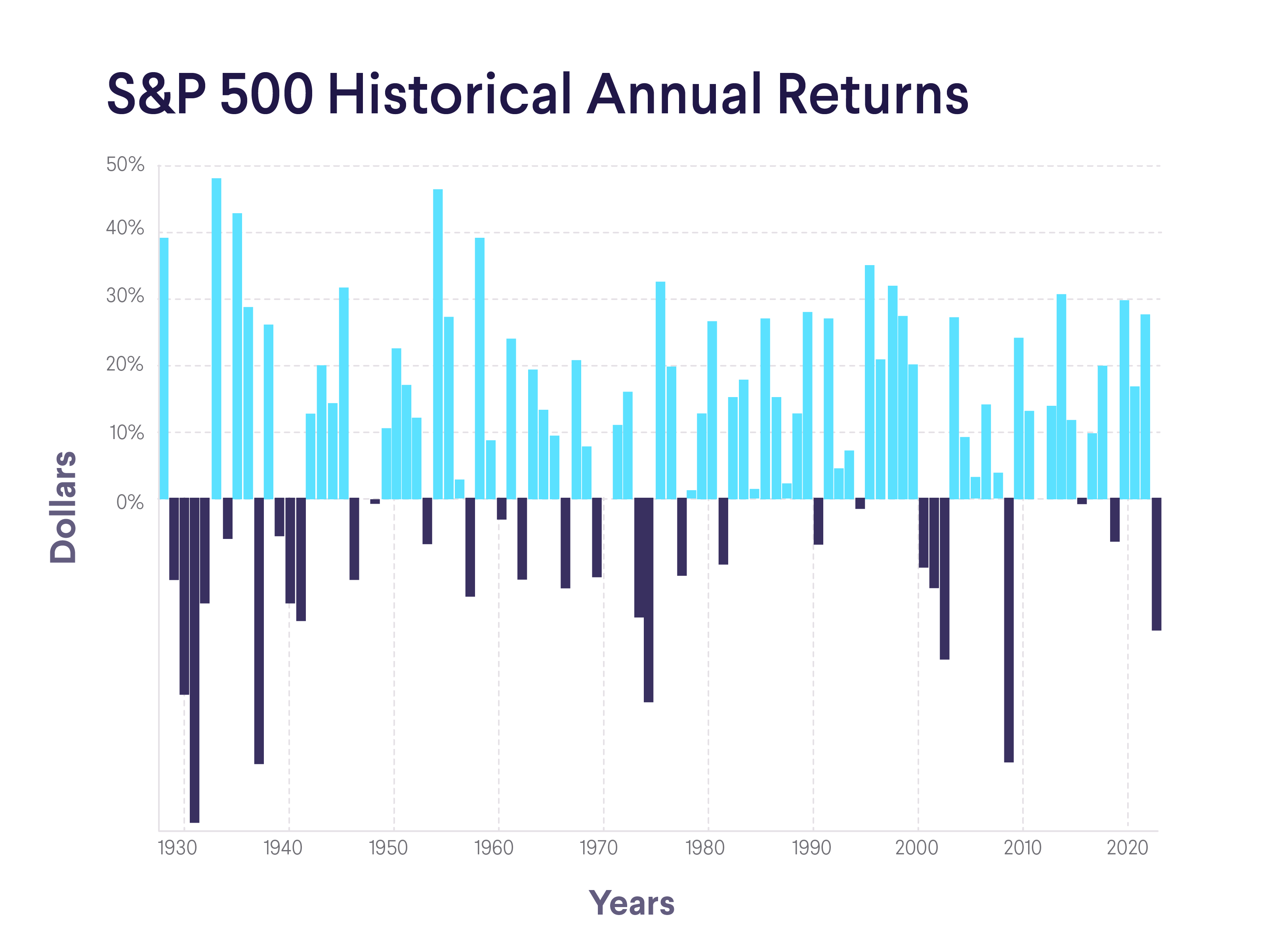

Historical Average Stock Market Returns for S&P 500 (5-year to 150-year averages) - Trade That Swing

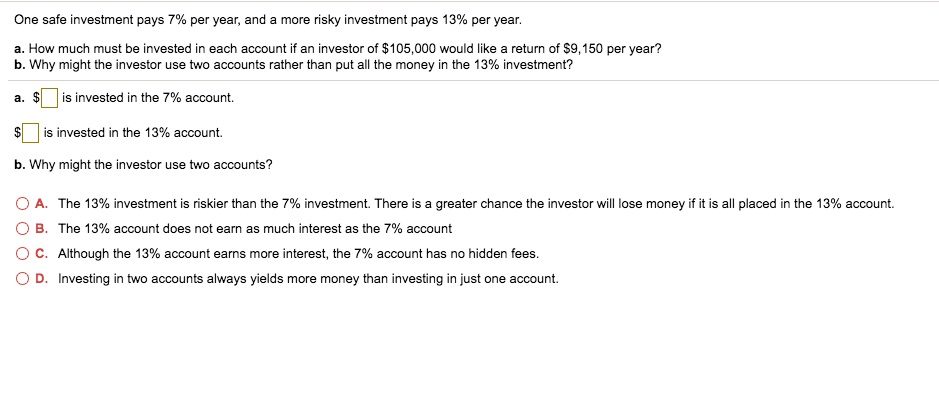

SOLVED: One safe investment pays 7% per year; and more risky investment pays 13% per year: How much must be invested in each account if an investor of 105,000 would like return

![S&P 500 returns by year! [The average return of the S&P 500 from 1926 to 2018 is about 11% per year] : r/FluentInFinance S&P 500 returns by year! [The average return of the S&P 500 from 1926 to 2018 is about 11% per year] : r/FluentInFinance](https://i.redd.it/3thl8xqm5xn71.jpg)

:max_bytes(150000):strip_icc()/Investopedia_Returnoninvestmentformula_colorv1-6d281839c5814e109e316ebbbb61a5bd.png)

:max_bytes(150000):strip_icc()/Annualized-Total-Return-FINAL-69a0de5921b84ad88984ae90ff4e3733.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_A_Guide_to_Calculating_Return_on_Investment_ROI_Aug_2020-02-221fa416eaef4e88bcdfd36dd9553bdd.jpg)