European Union tax policy – Background to key issues in the debate on taxation matters in the EU | Epthinktank | European Parliament

Commission launches debate on a gradual transition to more efficient and democratic decision-making in EU tax policy | News | Hot | Bulgarian Industrial Association

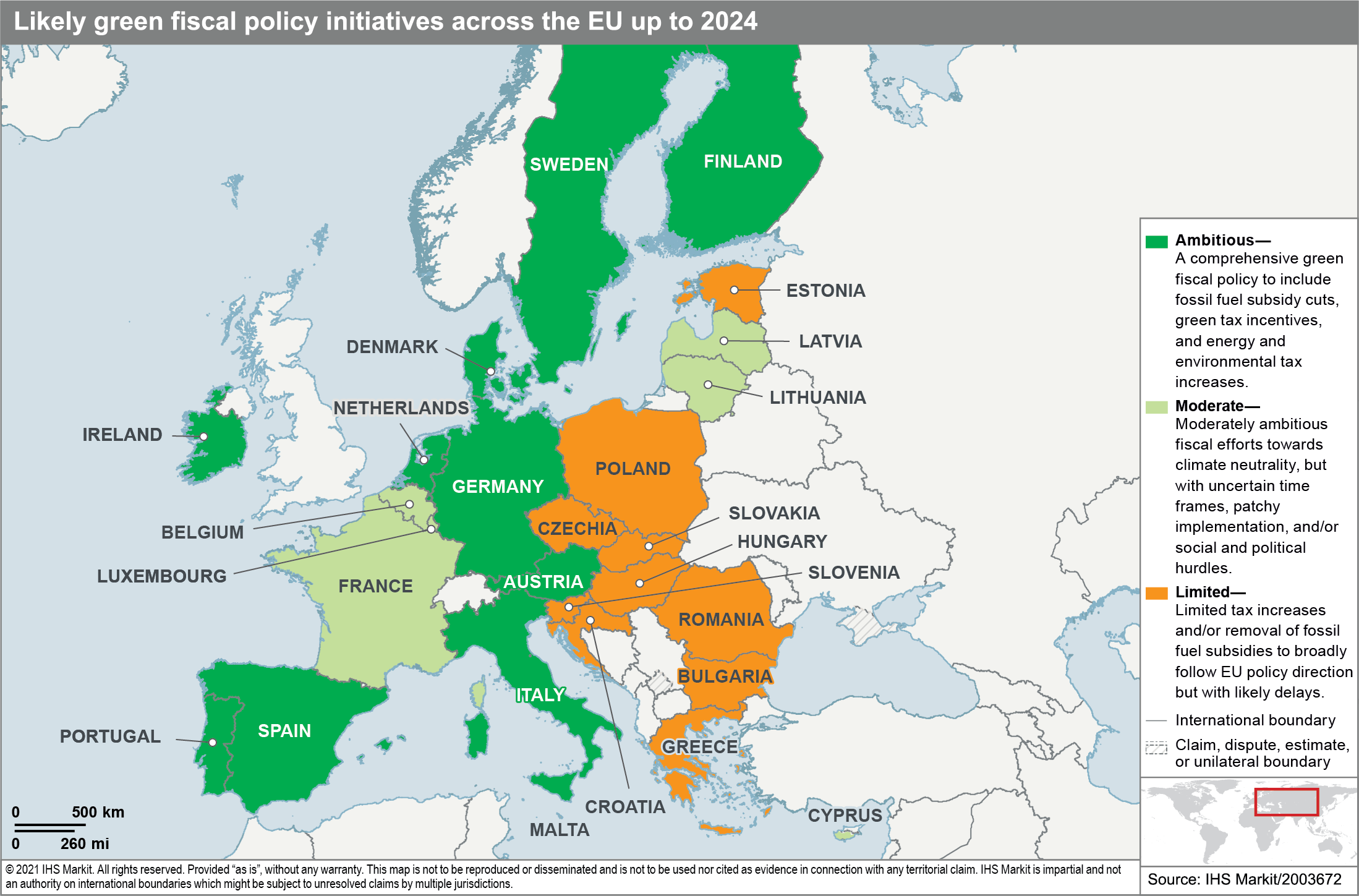

Using vehicle taxation policy to lower transport emissions: An overview for passenger cars in Europe - International Council on Clean Transportation

PUBLICATION: Tax Policy Reforms for Promoting Fair and Efficient Business Taxation in the EU | Zavod 14

Amazon.com: EU Tax Law and Policy in the 21st Century (Eucotax Series on European Taxation) (Eucotax Series on European Taxation, 55): 9789041188151: Werner Haslehner, Georg Kofler, Institute for Austrian and International Tax

European Commission on X: "For more on #QualifiedMajority and EU tax policy: → read our press release: https://t.co/AOoIBWLsrk → read our questions and answers: https://t.co/MgSTtOWgwp → visit our webpage: https://t.co/k6m9s8S8rc → follow @